When creator Mikayla Nogueira presses the shiny new “shop” tab at the top of her TikTok inbox, she’s promptly greeted with a sea of unread message requests.

“It’s everything you could imagine — not even just beauty — it’s like every brand possible is reaching out wanting me to use TikTok Shop with them,” said the 25-year-old makeup artist and beauty creator, who shot to fame on the platform during the height of the COVID-19 pandemic and now counts nearly 15 million followers on the app.

While it was just this month that TikTok formally rolled out its shopping integration to its 150 million U.S. users, Massachusetts-based Nogueira was among the first to use the feature while it was still in beta testing last year, doing a live shopping stream with E.l.f. Cosmetics in which she showcased the brand’s bestselling products.

“We were basically trying to see if TikTok Shop would be a hit — to see if people were willing to click the shopable icon, check out and actually go through with purchasing,” said Nogueira.

TikTok virality has been a catalyst for explosive beauty sales since the platform went mainstream in 2020, propelling products like the Dyson Airwrap, Dior Addict Lip Glow Oil and Charlotte Tilbury Airbrush Flawless foundation, among others, to new heights. Now, the social platform aims to create a one-stop shop in which users can seamlessly purchase the products they’re already discovering on TikTok.

In short, the phrase “TikTok made me buy it” is getting literal.

“TikTok Shop is the first time we’ve done social shopping with a major partner that has really leaned into what their strengths are as a social platform,” said Toto Haba, senior vice president of marketing and communications at Benefit Cosmetics.

The shopping integration has meant big business for Benefit, which launched via TikTok Shop on Douyin — TikTok’s Chinese sister app — two years ago. “TikTok Shop probably accounts for about 30 percent of our total online sales in China, and about half of our business in China is done through online transactions,” said Haba, adding that Benefit launched on TikTok Shop in the U.K. in September 2022, followed by a U.S. foray this summer when the brand’s new Fan Fest Mascara, $28, launched exclusively on TikTok Shop for 48 hours before landing at Sephora, Ulta Beauty and its own e-commerce website.

Benefit hosted a 24-hour shopping livestream on TikTok to kick off the launch — making it the first U.S. brand to do so — and, two months later, sales of the Fan Fest Mascara via TikTok Shop are still outpacing those made through Benefit’s e-commerce website.

Most of these sales are generated through in-feed shopable videos by the brand’s roughly 1,000 hand-picked TikTok Shop affiliate creators. Live shopping — the main driver of Benefit’s TikTok Shop business in China — only generates between 10 percent and 20 percent of the brand’s U.S. TikTok Shop business.

“Having creators talk to their audiences in their own, authentic way is what has been taking off for us,” said Haba, noting that long-form, explanatory videos appear to be most effective in converting sales, and “more targeted” creators, or those with anywhere from 10,000 to 100,000 followers, are generating more sales than the mega-influencers Benefit has enlisted to help get its TikTok Shop presence off the ground.

According to TikTok, there are roughly 200,000 merchants on TikTok Shop in the U.S. and more than 100,000 users signed up for the integration’s affiliate program, which connects creators of all following sizes with sellers in order to earn commission on sales made via their content.

It’s up to brands how much commission they wish to offer creators, but “the best practice TikTok is guiding on is between 10 percent to 30 percent [commission] for creators — that’s the sweet spot where beauty brands should live,” said Leslie Ann Hall, cofounder and chief executive officer of Iced Media, the agency which onboarded Dieux Skin, Morroccanoil and Fékkai to TikTok Shop.

Brands and creators can promote products through four main modes on TikTok Shop: in-feed shopable videos — those which appear on the For You page and are tagged with the “eligible for commission” label in the lower left-hand corner; product showcases on a brand’s own TikTok page; live shopping, and the Shop tab, which is a kind of product marketplace currently available to 40 percent of U.S. TikTok users, with plans to go wider in October.

“The expectation for brands should be that the majority of these TikTok Shop sales are going to come from the For You page — TikTok seems to be prioritizing that organic visibility,” said Hall, adding that TikTok charges a transaction fee of two percent plus 30 cents per purchase made via TikTok Shop.

Brand storefronts, Hall said, probably won’t be much of a driving force for sales for the time being, because, “behaviorally, that’s just not how the consumer is shopping right now — for the most part, consumers probably don’t even know that [profile] tab exists; it’s not native behavior to TikTok.”

Beyond the seeming overnight prevalence of affiliate videos on the For You page, one of the main aspects of TikTok Shop generating buzz is the steep discounts the platform is offering users, particularly first-time shoppers, who are granted a 50 percent discount (up to $20 off) on their first TikTok Shop purchase.

“The incentives TikTok is offering for brands to test and learn are kind of unprecedented,” said Hall. “Whether it’s subsidizing coupons, subsidizing free shipping, subsidizing ad credits and promoting some of these shoppable videos at no cost to the advertiser — there are a lot of great perks for brands to onboard early.”

For indie brands like 4am Skin, founded by Jade Beguelin and Sabrina Sade, these subsidized costs pose a huge strategic benefit when it comes to new customer acquisition.

“We definitely saw a big boost, pretty much from Day One, starting on TikTok Shop,” said Sade. “We wouldn’t be able to offer someone 50 percent off straight off the bat, but we’re not the ones incurring that cost — we’re getting paid full-price for someone to try our product, which is pretty cool for a smaller business,” said Sade. In the month that the brand has been on TikTok Shop, it has sold just over 1,000 of its reusable Overtime Undereye Masks, which retail for $16, via the platform.

“Historically, we’ve wanted to do informational videos and not just cool, trendy ones — they convert well even though they won’t get a lot of views,” said Beguelin, adding the brand’s post-purchase survey indicates 88 percent of 4am consumers have been finding the brand through TikTok even before its TikTok Shop debut. “Now with TikTok Shop, we’re seeing that those informational videos are both getting a lot of views and getting a lot of conversion, which is that kind of magic sauce — before, it was one or the other.”

Not all brands, though, have been as enthusiastic about TikTok Shop’s discounting and myriad cost subsidizing — for which TikTok has yet to specify an end date.

“The subsidizing coupons — some of our prestige brands are not opting into that,” said Hall, noting many such brands have yet to come around to Black Friday discounting, much less this arrangement. “Even if TikTok is subsidizing those costs — some of these brands will not be associated with putting their product at a discount.”

In an ideal brand scenario, TikTok Shop will serve as an entry point for new consumers to a brand, without drawing existing consumers away from its other retail channels.

“Benefit Cosmetics is pretty widely distributed — the last thing we want is another website where you can buy Benefit that just cannibalizes our other partners,” said Haba, emphasizing the brand’s focus is cultivating TikTok Shop as a discovery platform. “One of the things we’re working on with TikTok is how to make social shopping work as a prestige brand, without being really discount-driven.”

For Dieux cofounder Charlotte Palermino, early-stage momentum on TikTok Shop has fueled a subsequent uptick in visitors to the brand’s own e-commerce website. “We see people buying through TikTok Shop, yes, but the bigger thing that we’ve seen is organic traffic — people are going to dieuxskin.com and going to research the product a little bit more and checking out our store — there’s been this amazing halo effect,” she said.

The way Palermino sees it, TikTok Shop has potential to serve as the ultimate Amazon-meets-QVC hybrid.

“So many companies have launched and said ‘we’re the QVC for the next generation,’ and I’m like ‘that already exists — it’s TikTok and Instagram, it’s just the disclosures weren’t clear until now,’” Palermino said.

In the two weeks that Dieux Skin has been on TikTok Shop, the brand has seen an average 80 percent uptick in revenue each time a TikTok Shop video promoting its new Instant Angel moisturizer goes viral.

Tarte Cosmetics, meanwhile, has tripled the sales of its TikTok Shop storefront since adding the shop capability to existing videos promoting its Maracuja lip balms and blushes. “Since we launched TikTok Shop, each day we have about double the new users,” said Samantha Kitain, chief marketing officer at Tarte.

“Typically what we see when we launch something is we’ll have one really big day of sales, and then things kind of go back to normal with a slight increase. Now we’re just getting this sustained engagement,” said Palermino, adding that she’s still “not putting all my eggs into [the TikTok Shop] basket,” but rather seeing the feature as “as one more arm in the arsenal.”

Because the brand has yet to harness affiliate creators, most of Dieux Skin’s momentum has been generated through videos uploaded by Palermino herself, who counts more than 394,000 followers on TikTok.

“We’re hand-selecting five creators to start, because I don’t love selling my products as something that works for everyone; we want people who have actually used our products before,” said Palermino.

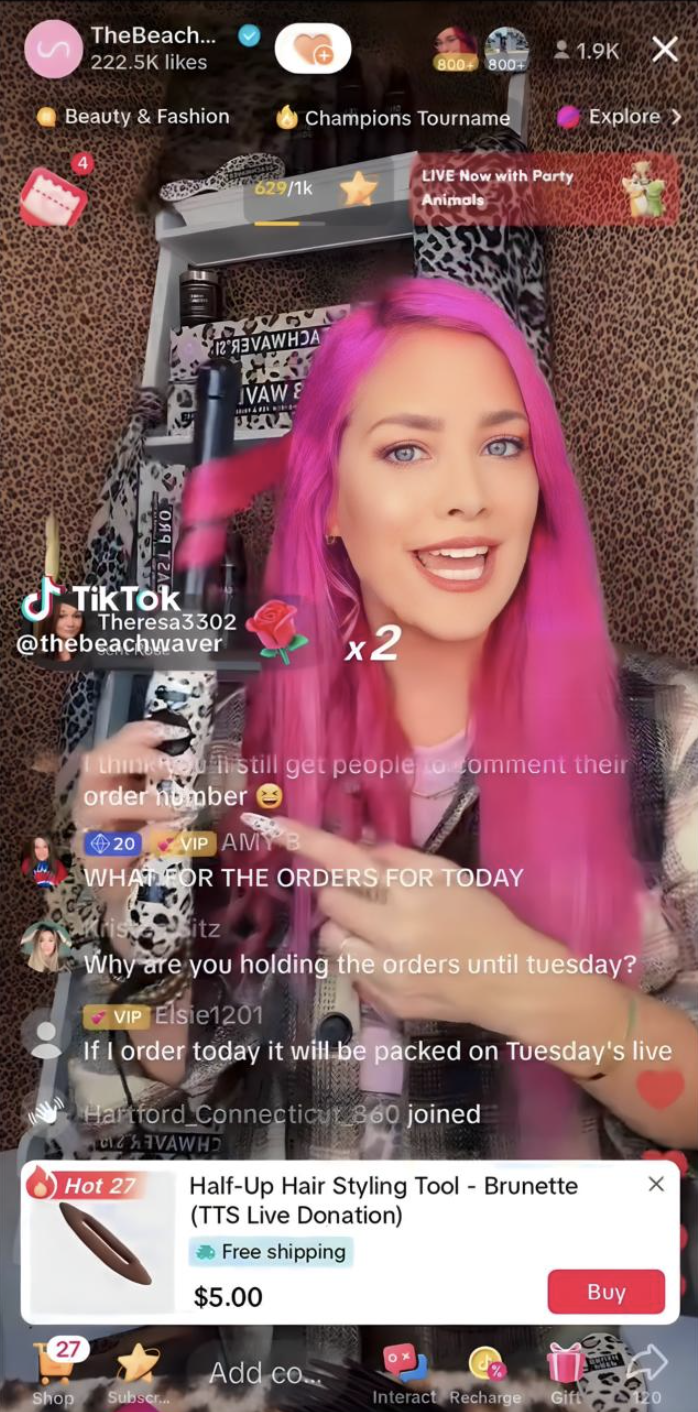

Hair tool brand The Beachwaver Co — which Spate reports is one of the most mentioned brands on TikTok alongside the #TikTokShop hashtag — is building momentum on TikTok Shop via live stream shopping, a strategy founder and celebrity hairstylist Sarah Potempa has long enlisted off the platform.

“We’re doing a community type of show — on Fridays I’ll do an educational, masterclass kind of show where I’ll teach people how to achieve a certain type of curl, and on Tuesdays I’ll pack orders in the warehouse and it’s a time for [customers] to shop live,” Potempa said.

For Gabi DeMartino, a beauty and lifestyle creator who first gained prominence on YouTube during the early 2010’s, TikTok Shop offers a streamlined way for creators to share recommendations to their audience. “I just like how TikTok is slowly but surely putting everything under one roof — in the OG YouTube days, it wasn’t that organized,” said DeMartino, whose primary platform is still YouTube, though TikTok is her fastest-growing.

Some brands like Summer Fridays, Youthforia and Kosas are testing the waters on TikTok Shop through retail partners like Revolve before rolling out stand-alone brand storefronts and affiliate efforts.

“We want to be mindful when we take on new platforms — Revolve is our only authorized retailer on TikTok Shop right now, and we’re seeing success with it,” said Summer Fridays cofounder Marianna Hewitt, adding the brand’s Lip Butter Balm is its best-performing stock keeping unit on TikTok Shop thus far.

Just like Amazon, though, TikTok Shop is grappling with a proliferation of unauthorized sellers peddling fake and counterfeit products. Sol de Janeiro, for example, is only officially sold on the platform through Revolve, yet merchants like The Wally Store and Unineed U.S. have collectively sold tens of thousands of Sol de Janeiro products via TikTok Shop — even enlisting popular creators to do so. Products by Summer Fridays, Saie, Tower 28 and numerous other brands are also being sold under unauthorized merchants on TikTok Shop.

“The same way that brands launch on Amazon purely to stop counterfeit, you’re going to see that on TikTok Shop,” said Palermino.

A spokesperson for TikTok said the company has counterfeit policies in place which prohibit fakes and dupes, and is taking action to remove products which infringe on intellectual property protection.

K18, which once upon a time joined Amazon mainly to combat unauthorized reselling and has since grown its presence with the e-tailer into a profitable arm for the business, is taking a slow-and-steady approach to TikTok Shop. The brand unveiled its profile storefront this week, and plans to onboard affiliates down the line as “phase two” of its strategy.

“Knowing that TikTok is now pushing Shop within the platform, that’s almost going to solve a gap that a lot of brands see when investing in performance marketing on TikTok,” said Cristina Szewczyk, vice president of digital at K18.

This also poses an advantage for creators when negotiating deals and commission rates with brands.

“We got a pitch from a creator in our inbox saying, ‘Hey, our client’s video went viral on TikTok Shop, she sold X amount of units, we’d love to partner on Shop’ — creators now have all these analytics and this data on their end that show how successful it can be for a brand to work with them,” said Hewitt.

And while brands like Tarte, 4am Skin and Dieux are mainly offering creator commission rates within the 10 percent to 20 percent range for now, Hall thinks it could be worth it for some to go bigger.

“If you’re not a household name brand and you want to get some top influencers to pay attention, why not go for a 50, 60, 70 percent commission rate and just see what happens?” said Hall, who thinks of TikTok Shop as “almost LTK [formerly known as Liketoknow.it] on steroids. We’re showing direct attribution on TikTok at a scale that we never have before.”

While it’s too early to tell the full impact of TikTok Shop on the beauty industry — and what its emergence means for competitors like Amazon and specialty beauty retailers — brands certainly appear to be approaching the feature with a tactical optimism.