The UK economy has been riddled with high inflation, pressures on discretionary spending and a shift toward experiential demands, resulting in bad news for the mid-market as it falls victim to an increasingly polarizing market.

With Next’s latest financial results released this week, we look at ways in which the retailer is adjusting to this competitive mid-market space.

Restoring price integrity a must in promotion-heavy midmarket

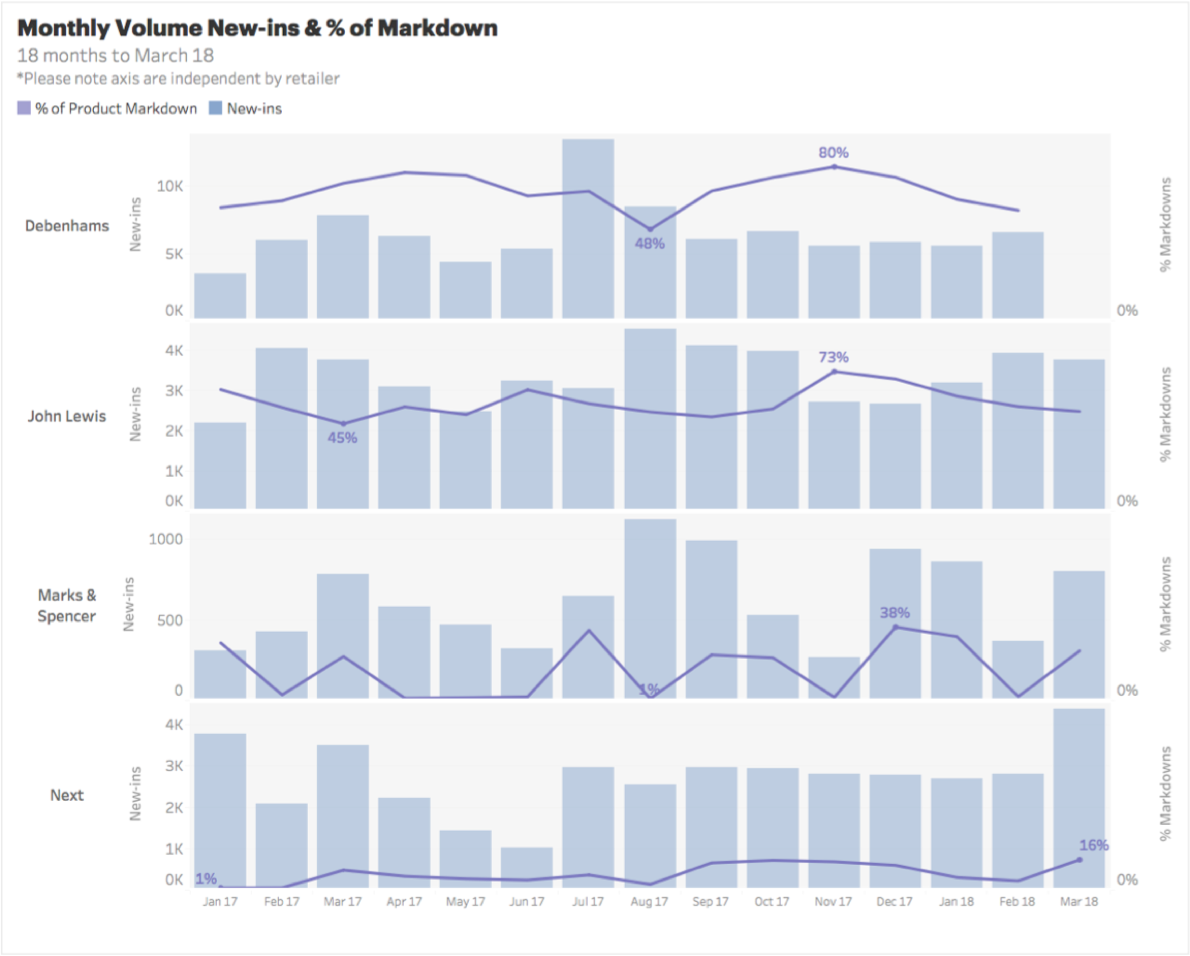

Next, along with M&S, have both, wisely, attempted to reduce markdowns in a bid to restore price-integrity – evident in their lower levels of markdowns as compared to mid-market peers (see chart below). The benefits of this are increasingly evident in Next’s full-price YOY sales growth.

However, to truly restore price integrity and drive demand for new-ins, this must be balanced with a more strategic approach to phasing, and a more ‘localised’ offer using consumer data. This is something Next is increasingly understanding and smartly working to rebalance.

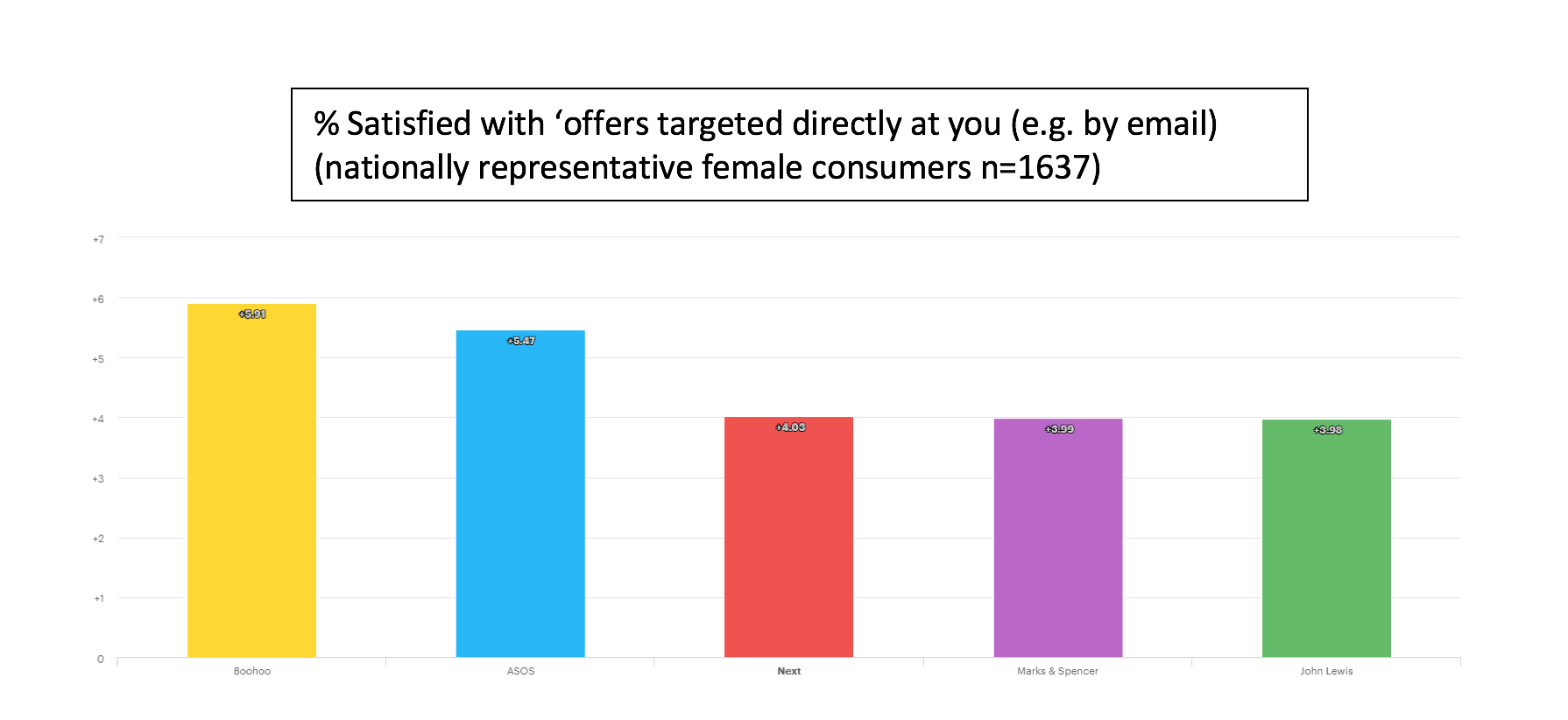

The chart below shows the % satisfied with ‘offers targeted directly to you (e.g. by email) and Next out-performs M&S and John Lewis. Although there is some way to catch with the leaders on this, Asos and Boohoo.

In 2017, Next learnt that their ranges were too fashion focussed for their intended audience and have started the process on rebalancing assortments according to their needs. These needs are now calculated using a new online system with the ability to create intelligent recommendations based on previous shops. Personalisation is a sure-fire way to speak right to the heart of core customers and in 2018, retailers must increasingly harness data to get the right product to the right customer at the right time, and at the right price.

Use online spaces as new product incubators

The growth in demand for online brings opportunities to test and experiment new ranges and offerings, rather than occupying crucial store space. John Lewis also uses this approach, bringing their Loved and Found collection online to appeal to a wider audience, whilst River Island are opening their online doors to stock third party menswear brands to test the waters.

Retailers need to be open to collaboration as the market only becomes more competitive and operating on an online platform ensures easy access to all.

Experiences are no longer enough

However, Next also value their stores as 50% of their online orders are delivered through them, providing opportunities to cross-sell their products via in-store experiences. Opening a florist, restaurant, card and stationary shop, barbers and even a car showroom in their Arndale store taps into needs for experiences and whilst this is successful, retailers have to be wary that these features will soon become an expected norm and have the potential to overshadow core products.

In order to drive purchases, a distinct, holistic view to merchandising is needed, including window displays and in-store visuals; eliminating the plain, white walls and marble lino seen in most mid-market department stores in order to build much-needed excitement (look to Selfridges and Harrods). Their stores are laid out as a shopping journey, seamlessly guiding shoppers through the beauty section to reach the nail bar rather than a separate entity. To implement this, features such as “buy this product and get a free personal styling session” are the perfect way to bring product and experience together and are a must-have for success in 2018.

NEED RETAIL DATA? Knowing when to back a trend, colour, category or item and knowing when to back off is crucial – you can’t afford to get it wrong. Know exactly what’s trending in retail across every category with WGSN InStock. Find out more here.

Know what’s next. Become a WGSN member today to benefit from our daily trend intelligence, retail analytics, consumer insights and bespoke consultancy services.